Mother's Day Sale

Mother's Day Sale

Save up to 70% sitewide

Find something special for the pet moms in your life (or treat yourself—we won't tell!).

Shop Bestsellers

Shop by category

Real pets. Real reviews. Real life.

80,000+ Reviews

Bestsellers

-

Regular priceFrom $149.99Regular price

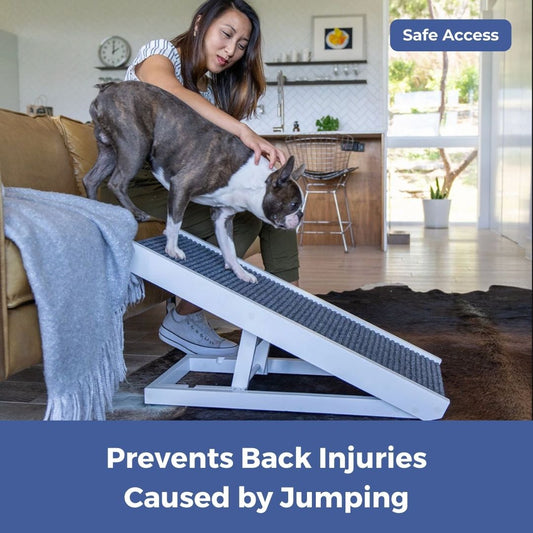

$229.99Sale priceFrom $149.99 Save $80.00 (34%)Unit priceperPawRamp™

2 colors

-

Regular priceFrom $79.99Regular price

$149.00Sale priceFrom $79.99 Save $69.01 (46%)Unit priceperPawProof Throw Blanket

2 colors

3 sizes

-

Regular priceFrom $32.00Regular price

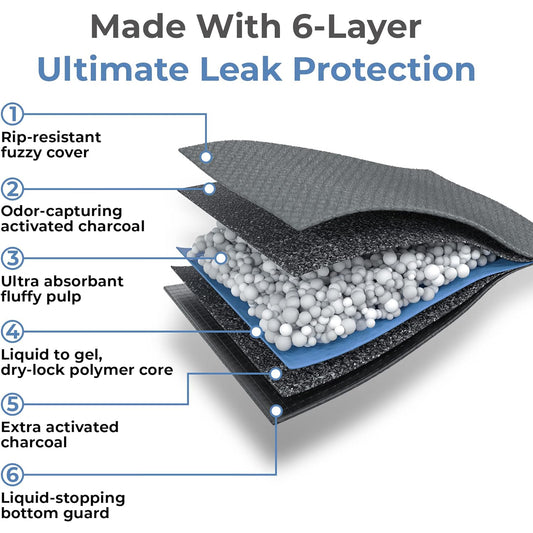

$44.00Sale priceFrom $32.00 Save $12.00 (27%)Unit priceperMagic Pee Pads XL

3 sizes

-

Regular priceFrom $34.00Regular price

$40.00Sale priceFrom $34.00 Save $6.00 (15%)Unit priceperMagic Pee Pads

3 sizes

Welcome to the pack!

At Alpha Paw, we believe our pets are part of the family, and family deserves the best. That’s why we’re committed to helping pet parents like you give your pup everything they need to live happier, healthier, and longer lives. Just honest, high-quality products designed & curated by pet parents, for pet parents.

Now that’s something to bark about.

FREE & Fast Shipping

Shipping is free for orders over $40 in the contiguous United States.

HAPPINESS GUARANTEE

If you're not 100% satisfied, we proudly offer returns within 30 days of purchase.

Outstanding Service

Email or chat with our devoted customer service reps anytime.

Best Gifts for Pet Parents

-

Regular price$39.00Regular price

$64.95Sale price$39.00 Save $25.95 (39%)Unit priceperCustom Pet Coffee Mug

-

Regular priceFrom $89.00Regular price

$149.95Sale priceFrom $89.00 Save $60.95 (40%)Unit priceperCustom Pet Fleece Blanket

2 sizes

-

Regular priceFrom $79.00Regular price

$119.95Sale priceFrom $79.00 Save $40.95 (34%)Unit priceperCustom Modern Pet Portrait

4 sizes

2 colors

-

Regular price$48.00Regular price

$78.95Sale price$48.00 Save $30.95 (39%)Unit priceperCustom Pet Couch Pillow with Cover

MEET OUR EXPERTS

Pets are family, and our mission is to help you be the best pet parent you can be.

Dr. Ross Bernstein, DVM

Dr. Addie Reinhard, DVM

Dr. Jo de Klerk, DVM

Dr. Sara Ochoa, DVM

Dr. Alexander Crow, DVM

Need Help?

We’re in the business of making tails wag – so when you’re not happy, we’re not happy. That’s why we’ve always seen customer satisfaction as our #1 priority.

Shipping Locations, Costs & Times

Shipping Locations, Costs & Times

We ship worldwide! For order processing and fulfillment, please allow at least 2 business days. Processing and fulfillment time frame applies to all orders, including expedited shipping orders.

Shipping is free for orders over $40 USD in the Contiguous USA. For other rates please enter your shipping address at checkout.

Domestic Shipping (within USA) takes 3-8 business days to arrive unless otherwise stated on the product page.

International orders (outside USA) may take an additional 10-15 days to arrive. Additional taxes and duties are paid by the customer.

Returns, Exchanges & Refunds

Returns, Exchanges & Refunds

We are very sorry that the product did not work for you! We proudly offer a 30-day money back guarantee of the purchase price of the item excluding a restocking fee. Please email our support team at support@alphapaw.com for assistance with your return.

Sales & Coupons

Sales & Coupons

From time to time we offer coupon codes, or have promotional sales on our website. Only one coupon code can be used per order, you can enter your code during the checkout process.

If you forgot to enter your code, our support team is more than happy to apply your discount code, post transaction! Email our support team at support@alphapaw.com within 24 hours of placing your order, and we will process your discount within 2 business days. Please note that multiple discounts cannot be applied to a transaction, but we will do our best to accommodate your request.